pinellas county sales tax on commercial leases

72 rows The problem is the state made over 160 million dollars a year on the tax so removing the tax must be done slowly over time. County legislators set the sales tax rate for their county by adding discretionary surtaxes to the basic state rate of 6.

Who S To Blame For High Housing Costs It S More Complicated Than You Think

For several years the state reduced the commercial rental sales tax rate small amounts with the latest reduction to 55 plus the local surtax effective January 1 2020.

. Florida imposes a sales tax of six percent on the total rent charged under a lease. It seems incredible but the landlord did exactly what the law requires as commercial lease lawyers will tell you. The landlord meanwhile has an obligation to remit collected sales tax to the Florida Department of Revenue DOR or face criminal charges.

A business may need to apply for a tax certificate before engaging in business activity. The minimum combined 2022 sales tax rate for Pinellas County Florida is. The 2018 United States Supreme Court decision in South Dakota v.

There was legislation to reduce the rate to 54 in 2021 however as part of the Covid-19 legislative package the state managed to pass delayed reduction in the commercial sales tax rental rate from 55 to 20. Effective January 1 2019 the sales tax rate for such rental payments will be reduced from 58 to 57 for rental payments received for occupancy periods beginning on or after January 1 2019. The State of Florida Requires that certain types of businesses collect sales tax.

PINELLAS has 2509 commercial real estate spaces for lease representing 14081419 sqft space. The Florida state sales tax rate is currently. The Pinellas County sales tax rate is.

The 2018 United States Supreme Court decision in South Dakota v. Has impacted many state nexus laws and. The Florida sales tax rates on commercial leases remains at 55 for 2022.

Effective January 1 2020 the State of Floridas sales tax rate on commercial real property lease payments including base rent and additional rent will be reduced from 57 to 55 for payments received for occupancy periods beginning on or after January 1 2020. Last April Senate Bill 50 provided a route to reduce the state sales tax rate on commercial leases see here The law requires a reduction in the sales tax rate from 55 to 2 after Floridas Unemployment Trust Fund is replenished to pre-pandemic levels. Pinellas County administers a 1 local option sales tax.

The Pinellas County Sales Tax is collected by the merchant on all qualifying sales made within Pinellas County. Official 2022 tax roll opens Nov 1. Tenants must pay sales tax on common area maintenance charges CAM required by their lease.

1st installment payment for 2022 property taxes due by June 30. This is the total of state and county sales tax rates. If you contract with an agentregistered platform to rent your property they should collect and pay the TD tax However if the agent fails to collect and pay the tax the owner will be held liable for the taxes Once your application is processed you will receive an email with instructions Please call 727-464-5007 with any questions.

The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pinellas County local sales taxesThe local sales tax consists of a 100 county sales tax. 2 particular payments made by a tenant may be classified as rental consideration and subject to sales tax including not only. 1 in specific situations counties are authorized to levy an additional discretionary sales surtax on the charges subject to sales tax.

This table shows the total sales tax rates for all cities and towns in Pinellas County including all local taxes. This will be the third such reduction in the last three years.

5 Reasons To Create A Commercial For Your Business

Hillsborough Developer Stephen Dibbs Battles Bureaucrats Yet Again

Citrus Springs Fl Property For Sale 373 W Homeway Loop Citrus Springs Cross City Property For Sale

How To Start A 125k Month Cleaning Business 2022 Upflip

How We Determine The Value Of Your Property Tangible Personal Property

How We Determine The Value Of Your Property Tangible Personal Property

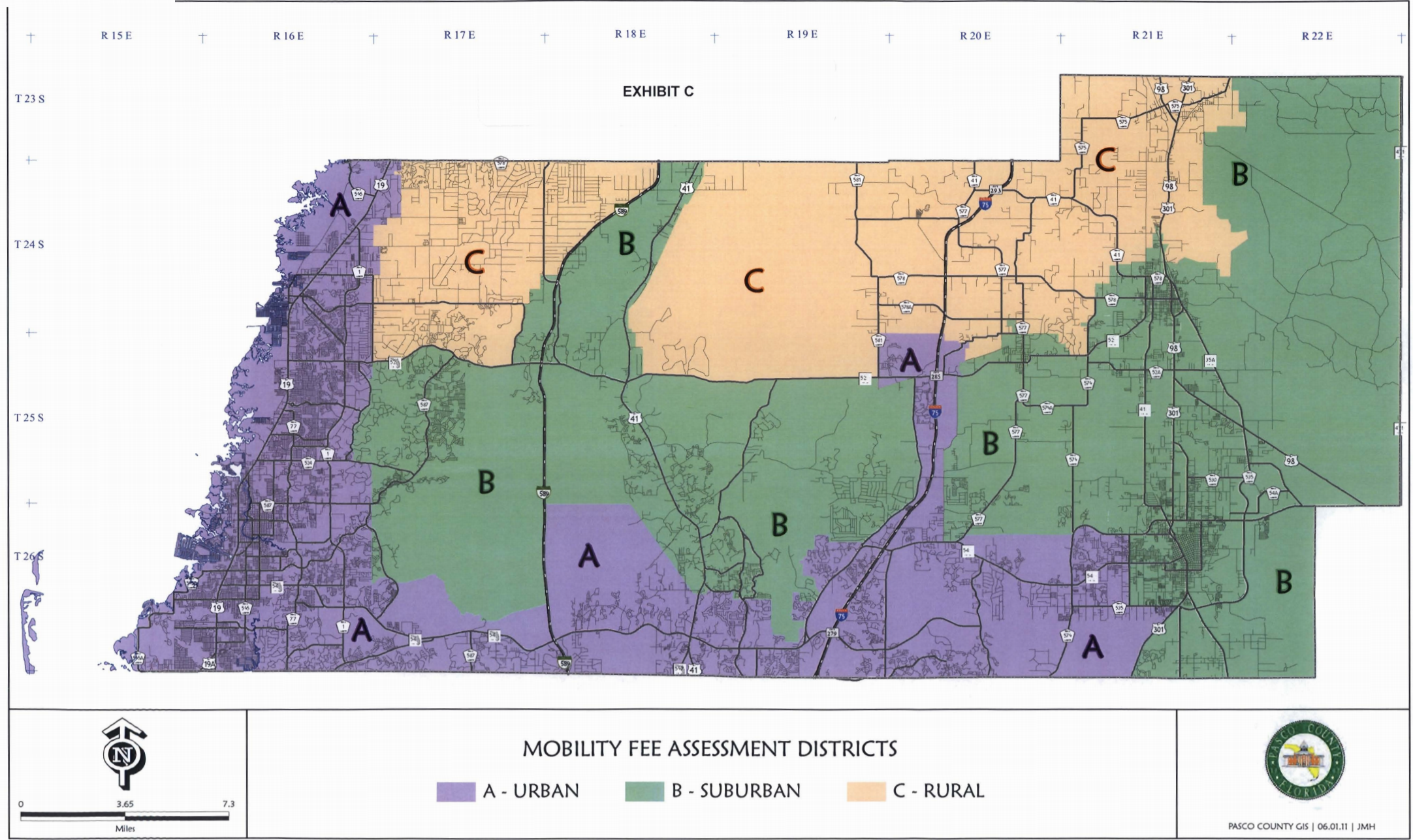

Fhwa Center For Innovative Finance Support Value Capture Case Studies Pasco County Florida Multimodal Mobility Fee Program

Florida Sales Tax Guide For Businesses

Who S To Blame For High Housing Costs It S More Complicated Than You Think

Pinellas County Hotel Acquisitions Continue To Rise Tampa Bay Business Journal

Pinellas County Hotel Acquisitions Continue To Rise Tampa Bay Business Journal